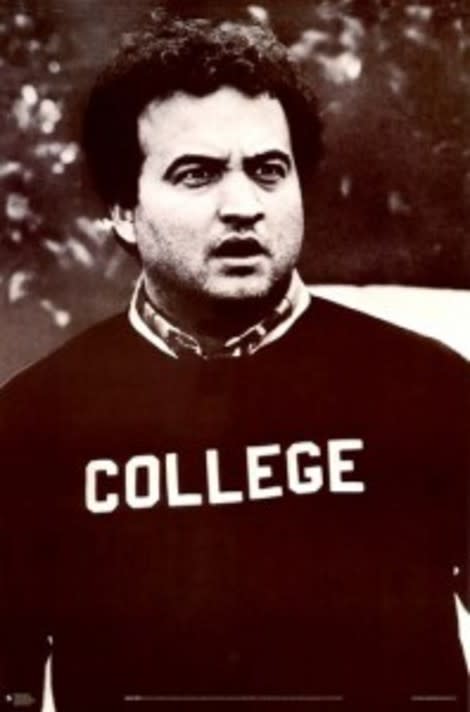

Paying for College in Today's Economy: What's Best for Your Family?

Parenting time is notoriously different than other time. Instead of being measured by moments on a clock, or dates on a calendar, it's mostly measured in milestones: first solid food, first steps, preschool, kindergarten, first soccer uniform, first middle school dance, starting high school, getting a driver's license, high school graduation, and then….the most overwhelmingly daunting parenting milestone of all: PAYING FOR YOUR KID TO GO TO COLLEGE!

AAAAAAAAAAAHHHHHHHHHHH!!!!!!!!!!!!!!!!!

And guess what? I am about to hit that terrifying super-milestone myself; this fall I will have one starting nursery school, one starting kindergarten, one starting his freshman year of high school, and one beginning her senior year at the same high school.

Senior year is one that I know all too well will go by in the blink of an eye for my daughter, and one that will see both of us consumed with college essays, entrance applications, SAT and ACT score angst, and perhaps most frighteningly, the painstaking filling out of financial aid applications.

Related: 28 ways to make your kid's teacher like you

Here's where I am going to admit that I am totally petrified regarding how I am going to pay for my oldest daughter's looming secondary education. For a variety of reasons, I got a very late start with saving for her schooling, and then I had a very unexpected and major savings setback in just the past six months. So now I am scrambling, and my high school senior and I are having very honest conversations about the fact that hard choices may have to be made.

I will also say that my attitudes about paying for college have shifted in recent years, as have those of many other Americans like me who have seen our economy fundamentally shift, with fewer and fewer college grads finding the jobs they once assumed were a given after they had that 4 year diploma in hand. Back when my now 16 year old daughter was a baby, I would have told you that I would do whatever it took to pay for her to go to even the most expensive - and let's face it, ultimately often wildly impractical - private liberal arts college. Today, however, my primary college planning goal is simple: as little debt as possible - for her and for me.

My generation - X - has learned the hard way that college and grad school debt is a quicksand trap from which it's difficult to ever fully escape. No one explained this very well to us when we were giddy 19 and 20 year olds, happily signing on the dotted line for those Pell Grants that would allow us to start classes - and parties - that fall. Now, though, we get it. We really, really get it. And I don't want my daughter to end up owing her future to SallieMae, nor do I want to be without any money for my husband and me to retire.

Related: 5 things ALL moms look forward to on the first day of school

Additionally, as my friend Meagan Francis writes, many of us were sold a bill of goods when our guidance counselors told us back in 1986 that college was the ONLY path to a successful and fulfilling life. That's simply not the case. A career as a trained craftsperson or in the trades will almost certainly provide a more reliable income these days than trying to carve out a career path armed with only an expensive, debt-weighted BA in English or Biology.

But when you have a child who really doen't have any interest in being a carpenter, welder, or CAD draftsperson (do people still do CAD drafting?), and who really wants to undertake that traditional, four year college pathway, you want that for her as well. In my daughter's case, at this point in the journey, she's eyeing law school after college, and every parent wants her child to live her dreams. Plus, she works very hard - she does her part - and I want to do my part, too.

If she's accepted to a school we cannot figure out how to afford without taking on debt - even with scholarships or other non-loan-type financial aid - holding the line on "no" will be very painful for me. I already know that. And it will also be painful if she ends up not receiving that longed-for acceptance letter from her first choice school, which (PRAISE JESUS) just happens to be our state's flagship public university, which would be relatively affordable for us to manage (emphasis on "relatively")

However, the odds of even strong in-state students getting into this university, which happens to be my own alma mater, have become much more challenging in recent years as the result of our state's adoption of a lottery to fund "HOPE Scholarships." These scholarships have been wonderful for in-state high school kids, significantly widening the pool of applicants who once might not have been able to afford college at all, much less a traditional four year degree at the "big" university.

Related: 15 things to teach your kids before they move out

However, that much broader pool of in-state applicants - many of them with high GPAs and ACT scores - means that many other in-state kids with solid application credentials who were once assured of acceptance can no longer count on that with absolute certainty, as was the case when I graduated high school. In other words, the flagship state university that's my child's first choice is no longer the default "fall back school" for our state's best students; instead it's become a very attractive option for kids who have the grades and test scores to go any number of places. But my daughter and I have our fingers crossed, because this really would be the best option, money-wise, and it's an outcome with which my daughter would be very happy.

I am now saving as aggressively as we are able for my three younger children's higher ed, but paradoxically, as I look over the financial aid forms I will soon be filling out for my eldest, I am realizing that saving for college is really a parental catch 22; having money tucked away to pay tuition may actually reduce the amount of financial aid for which your child is able to qualify, ultimately making it less likely that your child will be able to attend college without debt.

And thus, I am left pretty well confuzzled over the whole paying-for-college thing. It's one parenting task where there are no easy or sure answers, and where the likelihood is pretty good that your child may end up disappointed in her available options to greater or lesser degree.

I know that if I am ultimately unable to fund the school she most wants to attend, and that accepts her, I will feel a sense of some failure as her mom, but I also know that I will serve her transition to adulthood best if I am honest and realistic with her now about the fact that life really is all about tradeoffs and hard choices. As Mick Jagger says - and as I repeat often to the great annoyance of all of my children - you really can't always get what you want.

- By Katie Granju

Follow Katie on Babble

For 5 things you MUST do before school starts this fall, visit Babble!

MORE ON BABBLE

10 reasons why teenagers are better than toddlers

8 days during the school year when kids can use an extra pick-me-up

10 things teachers want parents to know

7 things teens can learn from watching "Teen Mom"

10 life skills every teen should know

Get updated on the 50 most interesting names in parent blogging. Follow Babble Voices onFacebookandTwitter.